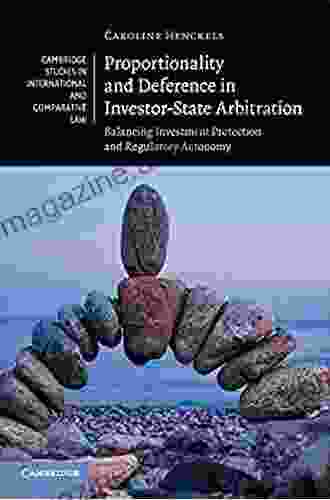

Balancing Investment Protection And Regulatory Autonomy

In today's globalized economy, foreign investment plays a crucial role in promoting economic growth and development. However, the tension between investment protection and regulatory autonomy poses a significant challenge for policymakers and legal practitioners.

5 out of 5

| Language | : | English |

| File size | : | 1774 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 257 pages |

Investment protection refers to the legal frameworks that safeguard the rights and interests of foreign investors. These frameworks typically include bilateral investment treaties (BITs),multilateral agreements, and domestic laws.

Regulatory autonomy, on the other hand, refers to the right of states to regulate their economies in the interest of their citizens. This includes the ability to impose environmental, health, safety, and other regulations that may affect foreign investments.

Balancing investment protection and regulatory autonomy is a complex task that requires a careful consideration of the interests of both investors and states. This comprehensive guide explores the intricate relationship between these two concepts, providing valuable insights for policymakers, investors, and legal professionals.

Investment Protection

Investment protection is essential for encouraging foreign investment. Investors need to have confidence that their investments will be protected from arbitrary or discriminatory treatment.

There are a number of different mechanisms that can be used to provide investment protection, including:

- Bilateral investment treaties (BITs): BITs are agreements between two countries that provide for the protection and promotion of investments.

- Multilateral agreements: Multilateral agreements, such as the World Bank's Convention on the Settlement of Investment Disputes (ICSID),provide a framework for the settlement of investment disputes.

- Domestic laws: Domestic laws can also provide for the protection of foreign investments. For example, many countries have laws that prohibit the expropriation of foreign property without compensation.

Investment protection is not absolute. States have the right to regulate their economies in the interest of their citizens. However, any regulations that affect foreign investments must be fair and non-discriminatory.

Regulatory Autonomy

Regulatory autonomy is essential for states to protect their citizens and promote their economic development. States need to be able to impose regulations that protect the environment, health, safety, and other important interests.

However, regulatory autonomy can also be used to discriminate against foreign investors. For example, a state could impose a regulation that is specifically designed to discourage foreign investment in a particular sector of the economy.

To avoid this, it is important for states to have clear and transparent regulatory frameworks. States should also provide foreign investors with the opportunity to participate in the regulatory process.

Balancing Investment Protection And Regulatory Autonomy

Balancing investment protection and regulatory autonomy is a complex task. There is no one-size-fits-all solution. The best approach will vary depending on the specific circumstances of each case.

However, there are a number of general principles that can be used to guide policymakers and legal practitioners in this area. These principles include:

- Transparency and Predictability: Regulatory frameworks should be clear, transparent, and predictable. This will help investors to make informed decisions about whether or not to invest in a particular country.

- Non-Discrimination: Regulations should be applied in a non-discriminatory manner. This means that foreign investors should not be treated less favorably than domestic investors.

- Proportionality: Regulations should be proportionate to the legitimate objective that they are seeking to achieve. This means that regulations should not be unnecessarily burdensome or restrictive.

- Compensation: If a state expropriates a foreign investment, it must provide the investor with fair and equitable compensation.

By following these principles, policymakers and legal practitioners can help to create a balance between investment protection and regulatory autonomy. This will help to promote foreign investment and economic growth, while also protecting the interests of citizens and the environment.

Balancing investment protection and regulatory autonomy is a complex but essential task. By following the principles outlined in this guide, policymakers and legal practitioners can help to create a framework that encourages foreign investment while also protecting the interests of citizens and the environment.

This comprehensive guide provides a valuable resource for policymakers, investors, and legal professionals who are seeking to understand the complex relationship between investment protection and regulatory autonomy.

5 out of 5

| Language | : | English |

| File size | : | 1774 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 257 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Kenneth V Hardy

Kenneth V Hardy Kevin Thompson

Kevin Thompson Patrice Williams Marks

Patrice Williams Marks Kate Siobhan Mulligan

Kate Siobhan Mulligan Karla Brandau

Karla Brandau Robert W Kirby

Robert W Kirby Karen Hesse

Karen Hesse Kathy Evans

Kathy Evans Katherine Preston

Katherine Preston Kate West

Kate West Kevin Michael Deluca

Kevin Michael Deluca Keri Arthur

Keri Arthur Kimberly Lord Stewart

Kimberly Lord Stewart Kathleen Slaney

Kathleen Slaney Kent D Lee

Kent D Lee Kathy I Lester

Kathy I Lester Kevin Dwyer

Kevin Dwyer Kim Rodgers

Kim Rodgers Kim Leatherdale

Kim Leatherdale Karen Ralls

Karen Ralls

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Garrett BellBig Letters, Bigger Words: A Journey into the Enchanting World of Kay Story's...

Garrett BellBig Letters, Bigger Words: A Journey into the Enchanting World of Kay Story's... Joshua ReedFollow ·15.1k

Joshua ReedFollow ·15.1k Maurice ParkerFollow ·6.4k

Maurice ParkerFollow ·6.4k Dwight BellFollow ·16k

Dwight BellFollow ·16k Roger TurnerFollow ·6.1k

Roger TurnerFollow ·6.1k Damon HayesFollow ·2.3k

Damon HayesFollow ·2.3k Chadwick PowellFollow ·13.1k

Chadwick PowellFollow ·13.1k Clayton HayesFollow ·3.3k

Clayton HayesFollow ·3.3k Derrick HughesFollow ·16.4k

Derrick HughesFollow ·16.4k

Francis Turner

Francis TurnerLearn to Make the Perfect Tapas Dishes Through the...

If you're looking to...

Victor Turner

Victor TurnerUnlock the Secrets of Publishing Law: A Comprehensive...

Embark on a literary journey where the...

Casey Bell

Casey BellHealing Crystals: Essential Crystals for Beginners

Unveiling the Mystical...

Nick Turner

Nick TurnerOne Hundred Years of Fire Insurance: A History of...

Chapter 1: The...

5 out of 5

| Language | : | English |

| File size | : | 1774 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 257 pages |